Eddie Murphy $15M Art Investment Journey

The Unexpected Art Collector

In the world of art investment, the story of Eddie Murphy’s acquisition of the iconic “Sugar Shack” painting offers a compelling case study. During a recent appearance on Jimmy Kimmel Live, the legendary comedian revealed that he owns the original “Sugar Shack” painting, a piece of art that holds significant cultural and financial value. Originally created by Ernie Barnes, the painting gained widespread recognition as the album cover for Marvin Gaye’s I Want You in 1976 and later became a beloved visual element of the Good Times TV show. Murphy’s story of how he came to own this masterpiece provides valuable insights into the potential of art investment.

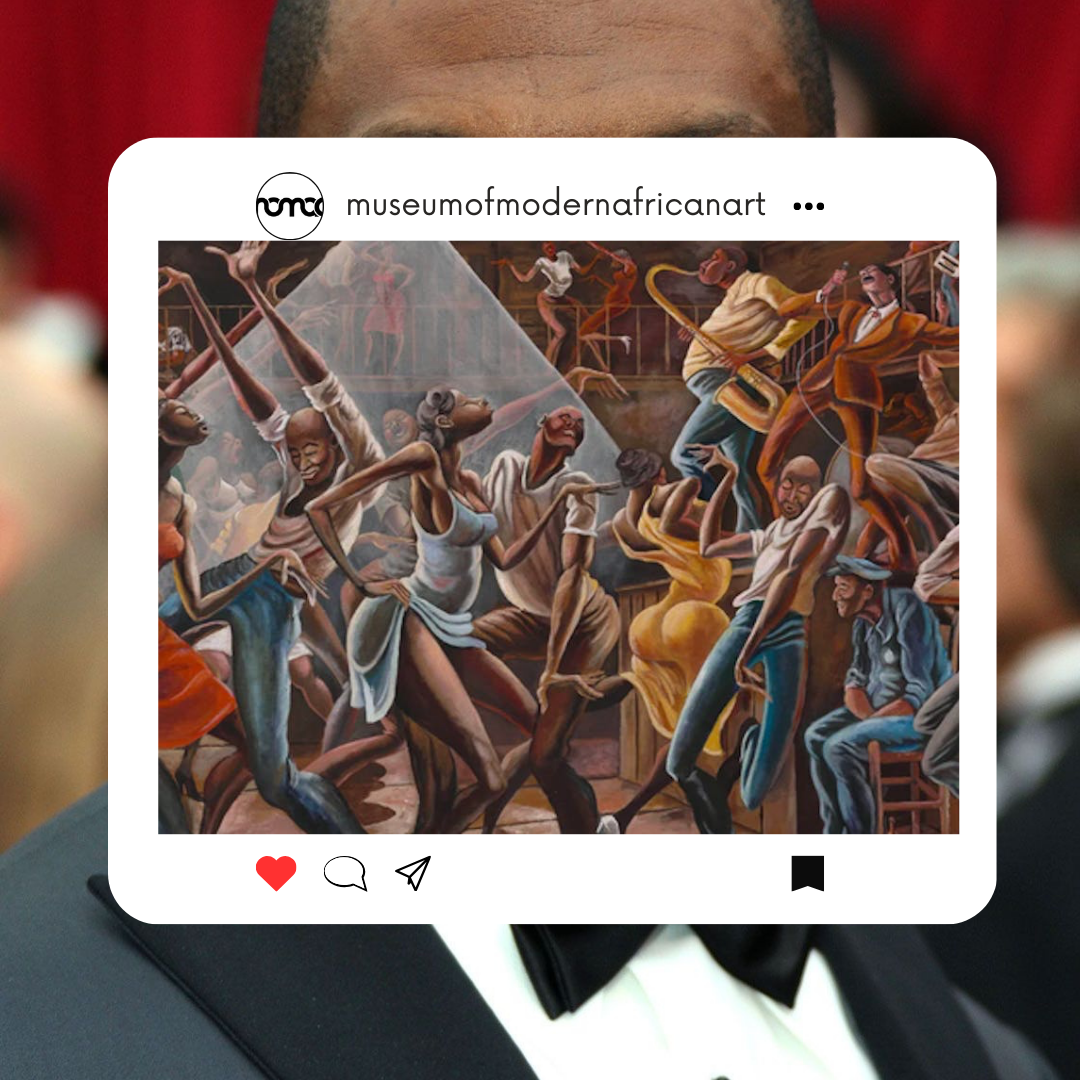

The Iconic “Sugar Shack” Painting

The “Sugar Shack” painting by Ernie Barnes is renowned not only for its artistic merit but also for its cultural significance. It captures the essence of a vibrant, spirited dance scene, reflecting the joy and energy of African American culture. When Marvin Gaye chose it for his album cover, the painting’s exposure skyrocketed, cementing its place in art and pop culture history. The painting’s weekly appearance in the Good Times credits further solidified its iconic status, making it a familiar and cherished image for millions.

Eddie Murphy’s Investment

Eddie Murphy’s journey into art investment began with his purchase of the “Sugar Shack” from Marvin Gaye’s estate. At the time, Murphy paid $50,000 for the painting, a significant amount but one that pales in comparison to its later valuation. Last year, the painting set an auction record at Christie’s, selling for over $15 million. Murphy’s investment exemplifies the dramatic returns that can be achieved through astute art investments, especially when the artwork in question holds substantial cultural significance.

Art Investment: A Lucrative Opportunity

The incredible appreciation of the “Sugar Shack” painting underscores the potential of art investment as a lucrative opportunity. Unlike traditional investments such as stocks or real estate, art can offer substantial returns based on both its intrinsic aesthetic value and its cultural impact. For those interested in diversifying their investment portfolios, art represents a unique asset class that combines financial potential with the pleasure of owning beautiful, historically significant works.

For more insights into the benefits and strategies of investing in modern African art, visit our comprehensive guide on African Modern Art Investment: Great Returns.

The Journey of “Sugar Shack”: From Album Art to Auction Block

Eddie Murphy’s Remarkable Art Investment

When Eddie Murphy purchased the “Sugar Shack” painting from Marvin Gaye’s estate, he paid $50,000. This transaction took place after Marvin Gaye’s tragic death in 1984, a time when art investment was not as mainstream as it is today. Murphy, known for his astute business acumen, recognized the cultural and artistic value of the painting. Over the decades, as the painting’s significance grew, so did its monetary value.

In 2022, the “Sugar Shack” shattered records at Christie’s auction house, selling for a staggering $15.275 million. This monumental sale not only highlighted the painting’s intrinsic worth but also underscored the power of art as a long-term investment. To illustrate the financial journey of Murphy’s investment, we can compare it to other traditional investment avenues over the same period.

| Investment | Purchase Price (1984) | Current Value (2022) | ROI (%) |

|---|---|---|---|

| Sugar Shack | $50,000 | $15,275,000 | 30,450% |

| S&P 500 Index Fund | $50,000 | $1,050,000 | 2000% |

| Gold | $50,000 | $400,000 | 700% |

| Real Estate | $50,000 | $800,000 | 1500% |

The Power of Cultural Significance in Art Investment

One key factor that can dramatically increase the value of art is its cultural significance. The “Sugar Shack” is not just a painting; it’s a symbol of African American culture, capturing the vibrant spirit of its era. Its appearances on Marvin Gaye’s album and Good Times amplified its visibility and emotional resonance with audiences.

Understanding Cultural Impact

Cultural impact plays a crucial role in the appreciation of art. Artworks that resonate deeply with a particular community or that capture pivotal moments in history tend to appreciate more significantly over time. The “Sugar Shack” is a prime example of this phenomenon. Its portrayal of African American life and its association with influential cultural moments provided a foundation for its tremendous valuation growth.

Why Art Investment Works – Eddie Murphy $15M Art Investment Journey

Art investment is unique compared to other investment types due to several factors:

1. Tangible Asset: Unlike stocks or bonds, art is a tangible asset that you can display and enjoy.

2. Diversification: Art can diversify an investment portfolio, reducing overall risk.

3. Non-Correlated Returns: The art market often moves independently of traditional financial markets.

4. Appreciation Potential: Significant pieces of art can appreciate dramatically over time, as seen with “Sugar Shack”.

For a deeper dive into the strategies and benefits of art investment, check out our article on African Modern Art Investment: Great Returns.

Art Investment vs. Traditional Investments

Comparing art investment to more traditional investments like stocks, bonds, and real estate highlights its unique benefits and potential pitfalls.

Stocks and Bonds

Stocks and bonds are traditional investment vehicles with a long track record of providing returns. They are liquid assets, meaning they can be easily bought and sold. However, they are subject to market volatility and economic downturns, which can erode their value.

Real Estate

Real estate is another popular investment choice. It offers the potential for steady income through rental yields and capital appreciation. Real estate investments are generally less volatile than stocks but can be influenced by economic conditions, interest rates, and market demand.

Gold

Gold is often seen as a safe-haven investment, particularly in times of economic uncertainty. It provides a hedge against inflation and currency fluctuations but does not generate income like real estate or stocks.

The Financial Performance of Art

The financial performance of art can be exceptional, as demonstrated by Eddie Murphy’s investment in the “Sugar Shack.” However, it’s important to note that not all art investments will yield such high returns. The key is to invest in pieces that have both artistic merit and cultural significance.

Chart Suggestion: Historical Art Investment Performance

A line graph showing the historical performance of art investments, with notable peaks corresponding to significant sales like the “Sugar Shack.”

The Future of Art Investment

Eddie Murphy’s experience with the “Sugar Shack” painting illustrates the tremendous potential of art investment. By choosing a piece with significant cultural impact, Murphy not only enjoyed owning a beautiful artwork but also reaped substantial financial rewards.

As the art market continues to evolve, opportunities for significant returns remain, particularly with pieces that resonate culturally and historically. For those interested in exploring this investment avenue, understanding the intricacies of art valuation and market trends is essential.

For a comprehensive guide on how to accurately appraise art, visit our Art Appraisal Guide 2024.

Discover the Value of Your Art

If you’re curious about the potential hidden gems in your collection, MoMAA.org offers professional art appraisal services. Our experts can provide accurate valuations, ensuring you understand the true worth of your pieces. Discover more about our appraisal services here: MoMAA Art Appraisal.

Embracing Art Investment

Eddie Murphy’s investment in Ernie Barnes’ “Sugar Shack” is a compelling example of the potential returns and cultural enrichment that come with art investment. This journey from a $50,000 purchase to a $15 million sale highlights not only the financial benefits but also the deep cultural significance and personal satisfaction that art can bring.

The Growing Market for Art Investment

The art market continues to grow, with increasing numbers of investors recognizing the value of diversifying their portfolios with art. Unlike traditional investments, art offers a tangible and aesthetically pleasing asset that can appreciate significantly over time, especially when the piece holds historical or cultural importance. As we have seen with “Sugar Shack,” the combination of these factors can lead to extraordinary financial returns.

For those looking to enter the world of art investment, understanding market trends and the importance of art appraisal is crucial. Investing in art requires not just financial acumen but also a passion for the pieces and their stories.

Getting Started with Art Investment

If you’re inspired by Eddie Murphy’s success and are considering investing in art, here are some steps to get you started:

1. Research: Understand the art market and identify pieces that have historical and cultural significance.

2. Appraisal: Get professional appraisals to understand the current value and future potential of the artworks you are interested in.

3. Diversify: Just like with any investment, diversification is key. Invest in a variety of art pieces to mitigate risk.

4. Passion: Invest in pieces that you love and that resonate with you personally. This makes the investment not just financially rewarding but also personally fulfilling.

For more guidance on purchasing art, explore our article on How to Buy Art Online in 2024.

MoMAA: Your Partner in Art Investment

MoMAA.org is dedicated to helping both new and seasoned investors navigate the art market. Our expert appraisal services ensure that you understand the true value of your art pieces, providing insights that can lead to informed investment decisions.

Discover the hidden gems in your collection and ensure you’re making the most of your art investments with our professional appraisal services. Visit our Art Appraisal Service to learn more.

The Timeless Value of Art

Art is more than just a financial asset; it’s a piece of history, culture, and personal expression. Eddie Murphy’s investment in the “Sugar Shack” is a testament to the timeless value of art. By investing in art, you not only have the potential for substantial financial returns but also the opportunity to own and cherish pieces that tell powerful stories and enrich your life.

Whether you are a seasoned investor or just beginning your journey, the world of art offers endless possibilities. Embrace the beauty, the history, and the potential that art investment can bring. Let MoMAA.org guide you through this fascinating journey, ensuring your investments are both meaningful and profitable.

No products in the basket.

No products in the basket.